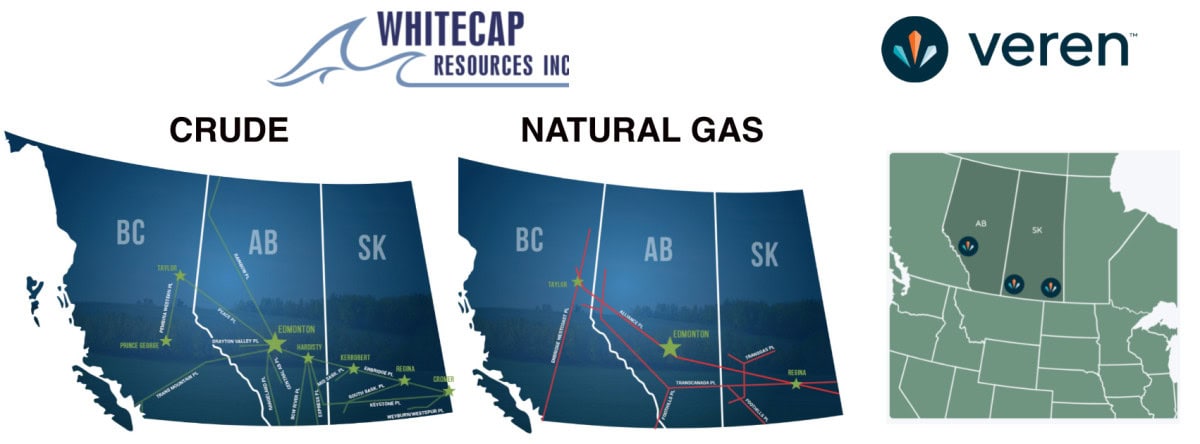

CALGARY, ALBERTA – Whitecap Resources Inc. (“Whitecap”) (TSX: WCP) and Veren Inc. (“Veren”) (TSX: VRN) (NYSE: VRN) are pleased to announce a strategic combination to create a leading light oil and condensate producer with concentrated assets in the Alberta Montney and Duvernay. The combined company will be the largest Alberta Montney and Duvernay landholder, a prominent light oil producer in Saskatchewan and will leverage the combined asset base and technical expertise to drive improved profitability and superior returns to shareholders.

The companies have entered into a definitive business combination agreement (the “Agreement”) to combine in an all-share transaction valued at approximately $15 billion, inclusive of net debt1. Under the terms of the Agreement, Veren shareholders will receive 1.05 common shares of Whitecap for each Veren common share held. The combined company will be led by Whitecap’s existing management team under the Whitecap name with four Veren directors to join the Whitecap Board of Directors, including the current President & CEO of Veren, Craig Bryksa. The transaction is expected to close before May 30, 2025.

Grant Fagerheim, Whitecap’s President & CEO, stated: “We are excited to bring together two exceptionally strong asset bases to create one world-class energy producer with one of the deepest inventory growth sets of both liquids-rich Montney and Duvernay opportunities, along with conventional light oil opportunities in some of the most profitable plays in the Western Canadian basin. Our combined company will include exceptional technical and support personnel from the two companies in both the office and field and an experienced Board of Directors that prioritizes sustainable and profitable growth to generate strong returns for our combined shareholders. We look forward to bringing Whitecap and Veren together and providing increased value to both sets of shareholders well into the future.”

Craig Bryksa, Veren’s President & CEO, stated, “This strategic combination unlocks significant value for all shareholders and together positions us as a stronger, more resilient company. With enhanced scale, deep inventory, and increased free funds flow generation, we’re building a business with a differentiated competitive advantage. Our combined balance sheet reinforces our financial strength and enhanced credit profile, ensuring the long-term success in an evolving market. Together we’re unlocking synergies, creating new opportunities, and setting the stage for sustainable growth.”

Asset Maps Courtesy of Whitecap Resources & Veren

Strategic Rationale

· Solidified Position Within the Large-Cap Universe: The combined company will have an enterprise value of $15 billion1 and 370,000 boe/d2 (63% liquids) of corporate production with significant overlap across both unconventional and conventional assets. The combined company becomes the largest Canadian light oil focused producer and the seventh largest producer in the Western Canadian Sedimentary Basin, with significant natural gas growth potential.

· Significant Size and Scale across the High Impact Montney and Duvernay: The combined company becomes the largest producer in the high margin Kaybob Duvernay and Alberta Montney with approximately 220,000 boe/d of unconventional production. The combined company becomes the largest landholder in the Alberta Montney and the second largest landholder across unconventional Montney and Duvernay fairways with 1.5 million acres in Alberta. The combined company boasts over 4,800 total development locations3 in the Montney and Duvernay to drive decades of future production growth.

· Leading Low Decline Light Oil Position in Saskatchewan: The combined company becomes the second largest producer in Saskatchewan with consolidated assets in west and southeast Saskatchewan. The combined business will have 40% of its conventional production under waterflood recovery supporting a decline rate of less than 20% on 150,000 boe/d of production. These foundational assets have approximately 7,000 development locations to support meaningful free funds flow generation into the future.

· Immediate Accretion: The combination is immediately accretive to Whitecap standalone funds flow per share1 (10%) and free funds flow per share1 (26%), before incorporating any benefit from expected synergies, highlighting increasing sustainability and an enhanced financial outlook for the combined shareholders.

· Visible Long-Term Synergies: Visible operating, capital and corporate synergies which, in addition to supply chain efficiencies, can generate meaningful savings. Anticipated annual synergies of over $200 million can be achieved independent of commodity prices and will begin to be captured upon closing of the transaction.

· Strong Credit Profile: Exceptional balance sheet with initial leverage of 0.9 times Net Debt to Funds Flow1 which is expected to continue to further strengthen to 0.8 times by year end 2026. Whitecap and Veren both have an investment grade credit rating of BBB (low), with a Stable trend, issued by DBRS, Inc. (“Morningstar DBRS”) and with the strength and increased scale of the combined company the credit profile is expected to improve, which has the potential to reduce the go-forward cost of debt and expand debt marketing opportunities.

· Pathway for Long-Term Growth and Value Creation: Reaching critical mass that is desirable in public markets increases the potential to expand the combined company’s shareholder base and achieve a greater market following. Pro forma scale, risk profile and increased market relevance is expected to drive multiple expansion to valuations that are more closely aligned with the large-cap peers. The combined company will continue to pay Whitecap’s annual dividend of $0.73 per share, representing a 67% increase in base dividend for Veren shareholders.

· Disciplined Leadership and Governance: The combined business will continue to be led by the Whitecap executive team, who have a long track record of operational excellence, financial discipline, strong safety performance and are focused on generating strong returns to shareholders. The Board of Directors will consist of eleven members, made up of seven directors from Whitecap and four directors from Veren.

Financial Summary

The combined company’s production forecast at closing is 370,000 boe/d (63% liquids) and based on commodity prices of US$70/bbl WTI and C$2.00/GJ AECO, the forecast annualized funds flow is $3.8 billion1. After annual capital investments of $2.6 billion4, free funds flow is forecast at $1.2 billion1. Detailed 2025 guidance will be provided on close of the transaction.

Concurrent with entering into the Agreement, Whitecap has received commitments from National Bank of Canada (“NBC”) and the Toronto Dominion Bank (“TD”) with National Bank Financial Markets and TD Securities, as Joint Bookrunners and Co-Lead Arrangers, for a $500 million increase to the company’s existing committed $2.0 billion credit facilities as well as commitments for an additional fully committed $1.0 billion credit facility from NBC, TD, Bank of Montreal, and Bank of Nova Scotia as Joint Bookrunners. On a combined basis, these facilities provide for $3.5 billion in total credit capacity available to Whitecap on closing to support the combination.

Combination Structure Details

The companies have entered into the Agreement to combine in an all-share transaction valued at approximately $15 billion, inclusive of net debt. Under the terms of the Agreement, Veren shareholders will receive 1.05 common shares of Whitecap for each common share of Veren held. Following the close of the transaction, Whitecap shareholders will own approximately 48% and Veren shareholders will own approximately 52% of the total common shares outstanding of the combined company.

It is anticipated that normal course monthly dividend payments will continue to be made by Whitecap and that Veren’s first quarter dividend will be paid in the normal course, after which Veren will not pay dividends, provided that, in the event that the transaction closes after May 31, 2025, Veren shareholders will be entitled to a Special Dividend comprised of a monthly dividend declared by the Veren Board and paid by Veren in respect of the month of May and every calendar month thereafter in which the Effective Date does not occur, in the amount of $0.03833 per Veren share (being one-third of Veren’s current quarterly dividend per Veren share).

The transaction is structured through a plan of arrangement in respect of the securities of Veren under the Business Corporations Act (Alberta) and is subject to the approval of at least two-thirds of the votes cast by holders of Veren common shares. The issuance of Whitecap common shares pursuant to the arrangement is subject to the approval of the majority of votes cast by holders of Whitecap common shares in connection with the transaction. Closing of the transaction will be subject to approval of the arrangement by the Court of King’s Bench of Alberta as well as other customary closing conditions, including the receipt of customary regulatory and Toronto Stock Exchange approvals. The transaction is expected to close before May 30, 2025.

An independent special committee (the “Special Committee”) of the Board of Directors of Veren was formed to consider and review the transaction on behalf of the Veren Board of Directors. Based on, among other things, the unanimous recommendation of the Special Committee, the Board of Directors of Veren unanimously determined that the transaction and the entering into of the Agreement are in the best interests of Veren, the transaction is fair to the Veren shareholders and approved the Agreement, and has unanimously recommended that Veren shareholders vote in favor of the resolution to approve the transaction at the special meeting of Veren shareholders to be held on or about May 6, 2025.

The Board of Directors of Whitecap unanimously determined that the transaction and the entering into of the Agreement are in the best interests of Whitecap, the transaction is fair to the Whitecap shareholders and approved the Agreement, and has unanimously recommended that Whitecap shareholders vote in favour of the resolution to approve the issuance of Whitecap common shares pursuant to the transaction at the special meeting of Whitecap shareholders to be held on or about May 6, 2025.

A joint information circular, which will include details of the transaction, is expected to be mailed to Whitecap and Veren shareholders in mid-April 2025.

Advisors

National Bank Financial Inc. and TD Securities acted as financial advisors to Whitecap. National Bank Financial has provided a verbal opinion to Whitecap that the exchange ratio under the plan of arrangement is fair, from a financial point of view to the Whitecap shareholders and is subject to the assumptions made and the limitations and qualifications in the written opinion of National Bank Financial. Burnet, Duckworth & Palmer LLP is acting as Whitecap’s legal advisor for the transaction.

BMO Capital Markets is acting as financial advisor to Veren, and Scotiabank is acting as financial advisor to the Special Committee of Veren. BMO Capital Markets and Scotiabank have each provided a verbal opinion to the Veren Board of Directors and the Special Committee, respectively, that the exchange ratio under the plan of arrangement is fair, from a financial point of view to the Veren shareholders and is subject to the assumptions made and the limitations and qualifications in the written opinions of BMO Capital Markets and Scotiabank. Norton Rose Fulbright Canada LLP is acting as Veren’s legal advisor for the transaction and Blake, Cassels & Graydon LLP is acting as legal advisor to the Special Committee.

CONFERENCE CALL AND WEBCAST

Whitecap and Veren will be hosting a joint conference call and webcast to discuss the transaction and will begin promptly at 6:30 am MT (8:30 am ET) on Monday, March 10, 2025.

The conference call dial-in number is: 1-888-510-2154 or (403) 910-0389 or (437) 900-0527

A live webcast of the conference call will be accessible on Whitecap’s website at www.wcap.ca and Veren’s website at www.vrn.com by selecting “Investors”, then “Presentations & Events”. Shortly after the live webcast, an archived version will be available on the companies’ websites. A presentation regarding the strategic combination of Whitecap and Veren is available on Whitecap’s website at www.wcap.ca.

For further information:

Grant Fagerheim, President & CEO Craig Bryksa, President & CEO

or or

Thanh Kang, Senior Vice President & CFO Ken Lamont, CFO

Whitecap Resources Inc. Veren Inc.

3800, 525 – 8th Avenue SW 2000, 585 – 8th Avenue SW

Calgary, AB T2P 1G1 Calgary, AB T2P 1G1

(403) 266-0767 (403) 693-0020

www.wcap.ca www.vrn.com

InvestorRelations@wcap.ca

NOTES

1 Annualized funds flow, annualized funds flow diluted ($/share) and net debt are capital management measures. Free funds flow is a non-GAAP financial measure. Free funds flow diluted ($/share) is a non-GAAP ratio. Enterprise value and net debt to funds flow are supplementary financial measures. Refer to the Specified Financial Measures section in this press release for additional disclosure and assumptions.

2 Disclosure of production on a per boe basis in this press release consists of the constituent product types and their respective quantities disclosed herein. Refer to Barrel of Oil Equivalency and Production & Product Type Information in this press release for additional disclosure.

3 Disclosure of drilling locations in this press release consists of proved, probable, and unbooked locations and their respective quantities on a gross and net basis as disclosed herein. Refer to Drilling Locations in this press release for additional disclosure.

4 Capital investments is also referred to as expenditures on property, plant & equipment.

Refer to full press release for forward-looking statements and advisories.