“We have competitively tendered major scopes of the development resulting in approximately 70% of total capital expenditure forecast as lump sum or fixed rate. The tendering process and direct engagement with contractors have confirmed both capability and capacity and has informed our forecast capital expenditure of $7.2 billion on a 100% basis. Woodside’s share of total capital expenditure is $4.8 billion, which includes approximately $460 million of capital carry for Pemex remaining as of the time of this decision.” – Trion Teleconference Transcript

“The $7.2 billion forecast total capital expenditure covers the full 24-well development.” -Trion Teleconference Transcript

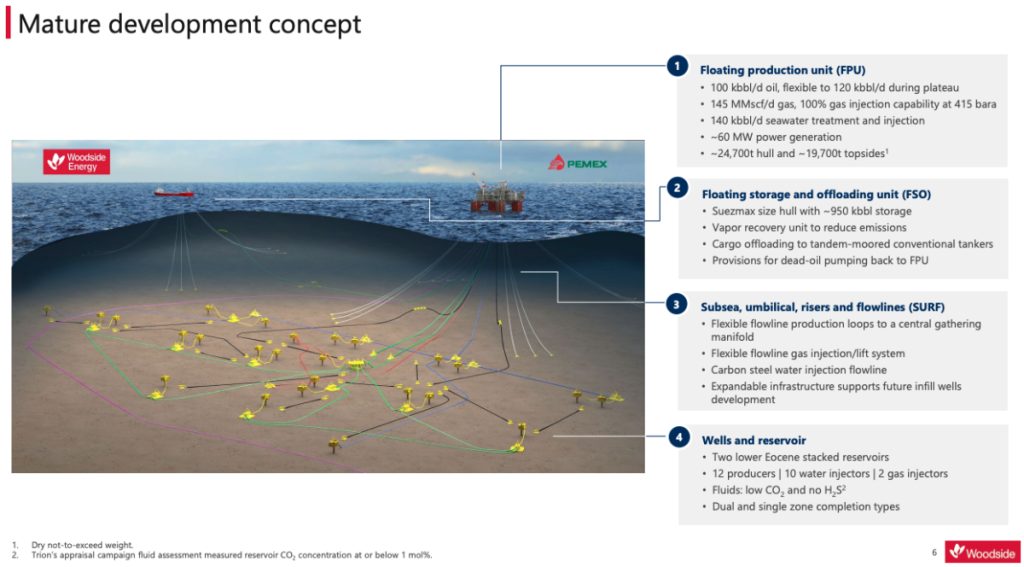

“Woodside has made a final investment decision to develop the large, high-quality Trion resource in Mexico. The expected returns from the development exceed Woodside’s capital allocation framework targets and deliver enduring shareholder value. First oil is targeted for 2028. The development is subject to joint venture approval and regulatory approval of the field development plan (FDP), expected in the fourth quarter of 2023. Woodside is operator with a 60% participating interest and PEMEX Exploración y Producción (PEMEX) holds the remaining 40%. The forecast total capital expenditure is US$7.2 billion (US$4.8 billion Woodside share including capital carry of PEMEX of approximately US$460 million) with the development expected to deliver strong returns to Woodside shareholders as well as economic and social benefits to Mexico. 1 The investment is expected to deliver an internal rate of return (IRR) greater than 16% with a payback period of less than four years.2 The forecast IRR excluding the capital carry is greater than 19%. The project will target the development of an estimated 479 MMboe of Best Estimate (2C) Contingent Resource (100%) of oil and gas (287 MMboe 2C Contingent Resources, Woodside net economic interest).3 The subsurface has been extensively appraised, with six well penetrations undertaken across the field, informing Woodside’s understanding of this large, high-quality conventional resource. The resource will be developed through a floating production unit (FPU) with an oil production capacity of 100,000 barrels per day. The FPU will be connected to a floating storage and offloading (FSO) vessel with a capacity of 950,000 barrels of oil.

Woodside’s greenhouse gas emissions reduction targets remain unchanged by the decision to approve investment in Trion. 4,5 The starting base for this target will not be adjusted as a result of the investment decision. Woodside CEO Meg O’Neill said Trion is an attractive addition to Woodside’s portfolio of high-quality producing assets in the Gulf of Mexico. “Trion is a valuable resource with a mature development concept. Our strong balance sheet and disciplined approach enable us to invest in opportunities such as Trion, expanding our global portfolio and delivering long-term value. “The investment is aligned with Woodside’s strategy, exceeds Woodside’s capital allocation framework targets and will be a strong contributor to Woodside’s cash flows, shareholder returns and the funding of future developments in oil, gas and new energy. “This development leverages Woodside’s proven expertise in deepwater project execution. The project’s tendering process has resulted in approximately 70% of total forecast capital expenditure as lump sum or fixed rates, with key contracts to be progressively executed following joint venture approval. “Trion has an expected carbon intensity of 11.8 kgCO2-e/boe average over the life of the field, which is lower than the global deepwater oil average, and will be subject to Woodside’s corporate net equity Scope 1 and 2 emissions reduction targets. 6 “We have considered a range of oil demand forecasts and believe Trion can help satisfy the world’s energy requirements. Two-thirds of the Trion resource is expected to be produced within the first 10 years after start-up. “We are developing Trion because we believe it will deliver value for Woodside shareholders and benefit for Mexico, including generation of jobs, taxation revenue and social benefit. We value the ongoing relationship with PEMEX and the support of the Mexican Government and regulators,” she said. Energy transition IPCC analysis shows there are a range of future energy transition pathways, including pathways which are consistent with limiting global temperature rise to less than 1.5°C and require new supply sources to meet demand. 7 Consideration of a range of climate-related factors as a part of the Trion investment decision gives Woodside confidence that Trion can responsibly fill that demand. The range of climate-related factors includes project Scope 1 and 2 greenhouse gas emissions, portfolio Scope 1, 2 and 3 lifecycle intensity, climate related risks and opportunities assessed in accordance with the Taskforce on Climate-related Financial Disclosures, demand resilience including 1.5°C pathways and portfolio free cash flow resilience across the IEA’s Net Zero Emissions (NZE) scenario.

Woodside believes that Trion is resilient in a decarbonising world, because of several factors including its forecast short payback period of less than four years, the fact that two-thirds of the resource is expected to be produced within 10 years from start-up, portfolio free cash flow resilience in the IEA NZE scenario and it having an expected all-in breakeven less than US$50/bbl.8,9 Trion is expected to have a carbon intensity of 11.8 kgCO2-e/boe over the life of the field, below the global deepwater oil average of 15 kgCO2-e/boe and global oil average of 27 kgCO2-e/boe averaged over the period 2022 to 2032. 10 About Trion Trion is located in a water depth of 2,500 m, approximately 180 km off the Mexican coastline and 30 km south of the Mexico/US maritime border. Trion was discovered in 2012 by PEMEX. BHP Petroleum acquired an interest in 2017 which subsequently became part of Woodside’s portfolio in 2022. Development of Trion, which is subject to joint venture and regulatory approval of the FDP, will include the installation of an FPU, an FSO, and 18 wells (nine producers, seven water injectors and two gas injectors) drilled in the initial phase, with a total of 24 wells drilled over the life of the Trion project. The forecast total capital expenditure of US$7.2 billion includes all 24 wells. Gas that is not reinjected or used on the FPU will be shipped to the Mexican markets. The Trion Asociación (Trion Joint Venture) comprises Woodside Petróleo Operaciones de México, S. de R.L. de C.V. (60%, operator) and PEMEX Exploración y Producción (40%)”

More info : Source: Woodside Media