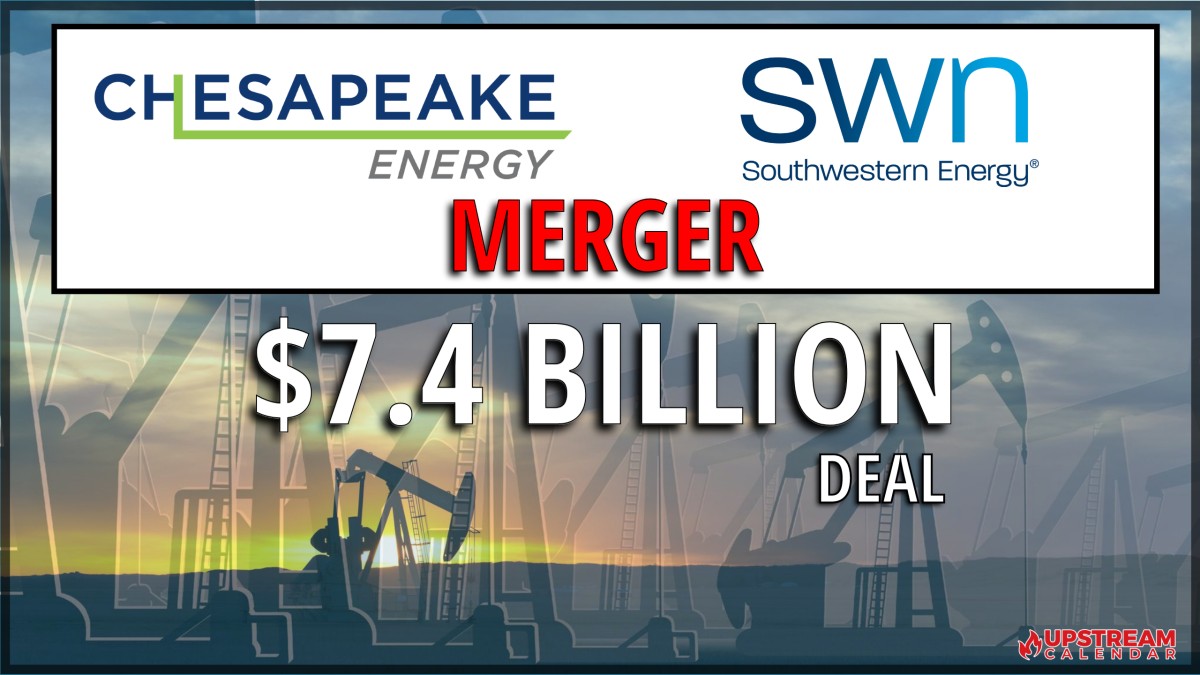

OKLAHOMA CITY and SPRING, Texas, Jan. 11, 2024 /PRNewswire/ — Chesapeake Energy Corporation (NASDAQ: CHK) and Southwestern Energy Company (NYSE: SWN) today announced that they have entered into an agreement to merge in an all-stock transaction valued at $7.4 billion, or $6.69 per share, based on Chesapeake’s closing price on January 10, 2024. Under the terms of the agreement, Southwestern shareholders will receive 0.0867 shares of Chesapeake common stock for each share of Southwestern common stock outstanding at closing.

The strategic combination will create a premier energy company underpinned by a leading natural gas portfolio adjacent to the highest demand markets, premium inventory, resilient free cash flow, and an Investment Grade quality balance sheet. The combined company, which will assume a new name at closing, will be uniquely positioned to deliver affordable, lower carbon energy to meet growing domestic and international demand with significant, sustainable cash returns to shareholders through cycles.

Transaction Highlights:

- Establishes industry’s premier natural gas portfolio: By combining high quality, large scale acreage in Appalachia and Haynesville, the pro forma company has current net production of approximately 7.9 Bcfe/d(1) with more than 5,000 gross locations and 15 years of inventory.

- Annual operational and overhead synergies of approximately $400 million: Identified synergies will enhance shareholder value through improved capital efficiencies and operating margins driven by longer laterals, lower drilling and completion costs, G&A reductions, and the utilization of shared operational infrastructure.

- Accretive to all key financial metrics: The combination is expected to be immediately accretive to all key per share financial metrics including operating cash flow, free cash flow, cash dividends, and net asset value, as well as ROCE.

- Creates global platform to expand marketing and trading business, reaching more markets, mitigating price volatility and increasing revenue: In order to maximize value of the combined company’s scale of production, Investment Grade quality capital structure and 100% certified Responsibly Sourced Gas, the company will build a global marketing and trading presence in Houston to supply lower-cost, lower carbon energy to meet increasing domestic and international LNG demand.

- Increases shareholder value through synergy enhanced, best-in-class return framework: Through Chesapeake’s existing shareholder return framework, the combined company expects an approximate 20% improvement in dividends per share over five years due to significant synergies and greater pro forma free cash flow generation.

- Investment Grade quality capital structure: The combined company remains committed to maintaining a net leverage ratio below one times and Investment Grade metrics resulting in a lower cost of capital and improved credit profile. These attributes will increase access to and returns from marketing and LNG opportunities.

- Sustainability leadership: The combined company will maintain its low natural gas emissions profile, commitment to achieving net zero Scope 1 and 2 GHG emissions by 2035, transparent disclosure on measurable targets, investment in low-carbon solutions, and social and governance excellence.

(1) Third quarter 2023 actual production for CHK and SWN from public filings; Excludes Eagle Ford

“This powerful combination redefines the natural gas producer, forming the first U.S. based independent that can truly compete on an international scale. The union creates a deep inventory of advantaged assets adjacent to high demand markets, allowing for the application of proven operational practices and the power of an Investment Grade quality balance sheet to drive significant synergies benefiting energy consumers and shareholders alike,” said Nick Dell‘Osso, Chesapeake’s President and Chief Executive Officer. “The world is short energy and demand for our products is growing, both in the U.S. and overseas. We will be positioned to deliver more natural gas at a lower cost, accelerating America’s energy reach and fueling a more affordable, reliable, and lower carbon future. I look forward to leading the talented workforce of the combined organization to accelerate the long-term value opportunity for our shareholders, employees, and all stakeholders.”

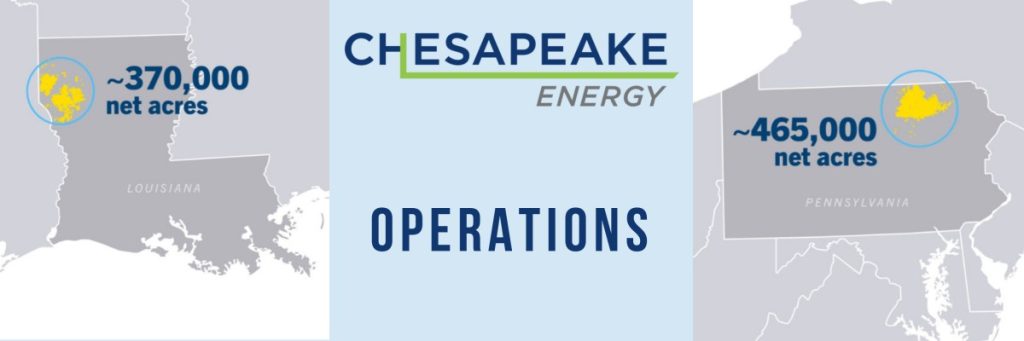

Chesapeake Operations

Southwestern President and Chief Executive Officer Bill Way added, “I want to thank the entire Southwestern team for positioning the company to be part of this transformational combination. Together, Southwestern and Chesapeake can drive improved margins and returns from our highly complementary portfolios through enhanced scale, capital allocation flexibility, and access to premium markets to supply growing global natural gas demand. Most importantly, both sets of shareholders are able to participate in the substantial value creation and future growth opportunities of the combined company, with one of the top shareholder return frameworks in the sector.”

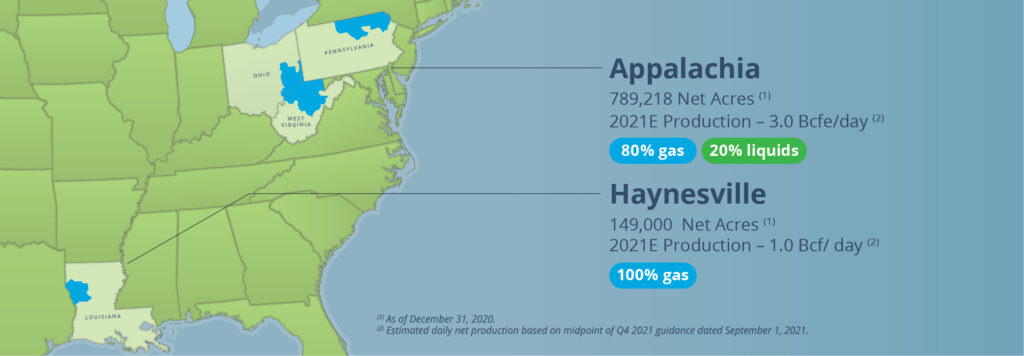

Map Of SWN Operations

Transaction Details:

Under the terms of the agreement, Southwestern shareholders will receive a fixed exchange ratio of 0.0867 shares of Chesapeake common stock for each share of Southwestern common stock owned at closing. At this exchange ratio and the respective share prices on January 10, 2024, the combined company would have an enterprise value of approximately $24 billion. Pro forma for the transaction, Chesapeake shareholders will own approximately 60% and Southwestern shareholders will own approximately 40% of the combined company, on a fully diluted basis.

The combination has been approved by the boards of directors of both companies. The transaction, which is subject to customary closing conditions, including approvals by Chesapeake and Southwestern shareholders and regulatory clearances, is targeted to close in the second quarter of 2024.

Governance:

Following the merger, the board of directors of the combined company will increase to 11 members and will initially be comprised of seven representatives from Chesapeake and four representatives from Southwestern. Mike Wichterich will serve as Non-Executive Chairman and Nick Dell‘Osso as President and Chief Executive Officer of the combined company. The combined company will be headquartered in Oklahoma City while maintaining a material presence in Houston and will assume a new name upon closing.

Advisors:

Evercore is serving as lead financial advisor, J.P. Morgan Securities LLC as financial advisor, Latham & Watkins LLP and Wachtell, Lipton, Rosen & Katz as legal advisors, and DrivePath Advisors as communications advisor to Chesapeake. Morgan Stanley also advised Chesapeake.

Goldman Sachs & Co. LLC. is serving as lead financial advisor and RBC Capital Markets, LLC along with BofA Securities and Wells Fargo Securities, LLC as financial advisors. Kirkland & Ellis LLP is serving as legal advisor, and Joele Frank as communications advisor to Southwestern Energy.

Conference Call Details:

The companies plan to host a joint conference call and webcast on January 11 at 9:00 a.m. EST to discuss the transaction. Institutional investors and analysts are invited to participate in the call by dialing 1-888-317-6003, or 1-412-317-6061 for international calls, using conference ID 5257732. Other parties are encouraged to participate through each company’s website: chk.com, or swn.com.

About the Companies:

Headquartered in Oklahoma City, Chesapeake Energy Corporation is powered by dedicated and innovative employees who are focused on discovering and responsibly developing leading positions in top U.S. oil and gas plays. With a goal to achieve net zero GHG emissions (Scope 1 and 2) by 2035, Chesapeake is committed to safely answering the call for affordable, reliable, lower carbon energy.

Southwestern Energy Company (NYSE:SWN) is a leading U.S. producer and marketer of natural gas and natural gas liquids focused on responsibly developing large-scale energy assets in the nation’s most prolific shale gas basins. SWN’s returns-driven strategy strives to create sustainable value for its stakeholders by leveraging its scale, financial strength, and operational execution.

IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS;

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction between Chesapeake and Southwestern, Chesapeake intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration statement”) to register the shares of Chesapeake’s common stock to be issued in connection with the proposed transaction. The registration statement will include a joint proxy statement of Chesapeake and Southwestern and will also constitute a prospectus of Chesapeake (the “joint proxy statement/prospectus”). Each of Chesapeake and Southwestern may also file other documents regarding the proposed transaction with the SEC. This document is not a substitute for the joint proxy statement/prospectus or the registration statement or any other document that Chesapeake or Southwestern may file with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT CHESAPEAKE, SOUTHWESTERN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

After the registration statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to the stockholders of Chesapeake and Southwestern. Investors will be able to obtain free copies of the registration statement and joint proxy statement/prospectus and other relevant documents containing important information about Chesapeake, Southwestern and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Chesapeake may be obtained free of charge on Chesapeake’s website at https://investors.chk.com/. Copies of the documents filed with the SEC by Southwestern may be obtained free of charge on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx.

PARTICIPANTS IN THE SOLICITATION

Chesapeake and Southwestern and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction contemplated by the joint proxy statement/prospectus. Information regarding Chesapeake’s directors and executive officers and their ownership of Chesapeake’s securities is set forth in Chesapeake’s filings with the SEC, including Chesapeake’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and its Proxy Statement on Schedule 14A, which was filed with the SEC on April 28, 2023. To the extent such person’s ownership of Chesapeake’s securities has changed since the filing of Chesapeake’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC thereafter. Information regarding Southwestern’s directors and executive officers and their ownership of Southwestern’s securities is set forth in Southwestern’s filings with the SEC, including Southwestern’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and its Proxy Statement on Schedule 14A, which was filed with the SEC on April 5, 2023. To the extent such person’s ownership of Southwestern’s securities has changed since the filing of Southwestern’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC thereafter. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proxy solicitations may be obtained by reading the joint proxy statement/prospectus and other relevant materials that will be filed with the SEC regarding the proposed transaction when such documents become available. You may obtain free copies of these documents as described in the preceding paragraph.

NO OFFER OR SOLICITATION

This communication relates to the proposed transaction between Chesapeake and Southwestern. This communication is for informational purposes only and shall not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may be identified by words such as “anticipates,” “believes,” “cause,” “continue,” “could,” “depend,” “develop,” “estimates,” “expects,” “forecasts,” “goal,” “guidance,” “have,” “impact,” “implement,” “increase,” “intends,” “lead,” “maintain,” “may,” “might,” “plans,” “potential,” “possible,” “projected,” “reduce,” “remain,” “result,” “scheduled,” “seek,” “should,” “will,” “would” and other similar words or expressions. The absence of such words or expressions does not necessarily mean the statements are not forward-looking. Forward-looking statements are not statements of historical fact and reflect Chesapeake’s and Southwestern’s current views about future events. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between Chesapeake and Southwestern, the expected closing of the proposed transaction and the timing thereof and the proforma combined company and its operations, strategies and plans, integration, enhancements to investment grade credit profile, emissions profile, debt levels and leverage ratio, capital expenditures, liquidity, return on capital employed, net asset value, cost of capital, operating cash flows, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, capital structure, achievement of investment-grade credit rating, expected accretion to earnings NAV, ROCE, cash flow and free cash flow, anticipated dividends, and natural gas portfolio, demand for products, quality of inventory and ability to deliver affordable lower carbon energy. Information adjusted for the proposed transaction should not be considered a forecast of future results. Although we believe our forward-looking statements are reasonable, statements made regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties and risks that are difficult to predict. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected.

Actual outcomes and results may differ materially from the results stated or implied in the forward-looking statements included in this communication due to a number of factors, including, but not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the possibility that Chesapeake stockholders may not approve the issuance of Chesapeake’s common stock in connection with the proposed transaction; the possibility that the stockholders of Southwestern may not approve the merger agreement; the risk that Chesapeake or Southwestern may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Chesapeake’s common stock or Southwestern’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Chesapeake and Southwestern to retain and hire key personnel, on the ability of and Southwestern to attract third-party customers and maintain its relationships with derivatives counterparties and on Chesapeake’s and Southwestern’s operating results and businesses generally; the risk that problems Chesapeake may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected; the volatility in commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace reserves; environmental risks, drilling and operating risks, including the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; exploration and development risks; the effect of future regulatory or legislative actions on the companies or the industry in which they operate, including the risk of new restrictions with respect to oil and natural gas development activities; the risk that the credit ratings of the combined business may be different from what the companies expect; the ability of management to execute its plans to meet its goals and other risks inherent in Chesapeake’s and Southwestern’s businesses; public health crises, such as pandemics and epidemics, and any related government policies and actions; the potential disruption or interruption of Chesapeake’s or Southwestern’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond Chesapeake’s or Southwestern’s control; and the combined company’s ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry. Other unpredictable or unknown factors not discussed in this communication could also have material adverse effects on forward-looking statements.

All such factors are difficult to predict and are beyond Chesapeake’s or Southwestern’s control, including those detailed in Chesapeake’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at http://investors.chk.com/ and on the SEC’s website at http://www.sec.gov, and those detailed in Southwestern’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Southwestern’s website at https://ir.swn.com/CorporateProfile/default.aspx and on the SEC’s website at http://www.sec.gov. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Chesapeake and Southwestern undertake no obligation to publicly correct or update the forward-looking statements in this communication, in other documents, or on their respective websites to reflect new information, future events or otherwise, except as required by applicable law. All such statements are expressly qualified by this cautionary statement. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

This presentation contains certain financial measures that are not prepared or presented in accordance with generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include EBITDAX and net debt. Non-GAAP financial measures are not measurements of financial performance under GAAP and should not be alternatives to amounts presented in accordance with GAAP. Chesapeake and Southwestern view these non-GAAP financial measures as supplemental and they are not intended to be a substitute for, or superior to, the information provided by GAAP financial results.

CHK INVESTOR CONTACT:

Chris Ayres

(405) 935-8870

ir@chk.com

CHK MEDIA CONTACT:

Brooke Coe

(405) 935-8878

media@chk.com

SWN INVESTOR CONTACT:

Brittany Raiford

(832) 796-7906

brittany_raiford@swn.com

SWN MEDIA CONTACT:

Andrew Siegel/Jed Repko

Joele Frank Wilkinson Brimmer Katcher

(212) 355-4449

Source Chesapeake Energy Press Release