This Article is Brought to you by: K+B Industries, leaders in machining premium threads

Creates the World’s Highest-Quality, Highest-Specification Offshore Drilling Fleet

Companies to Host Conference Call Today at 8 a.m. CT / 9 a.m. ET

STEINHAUSEN, Switzerland and HAMILTON, Bermuda, Feb. 09, 2026 (GLOBE NEWSWIRE) —

Transocean Ltd. (NYSE: RIG) and Valaris Limited (NYSE: VAL) today announced the signing of a definitive agreement to combine the two companies under which Transocean will acquire Valaris in an all-stock transaction valued at approximately $5.8 billion (all currency in USD).

The shareholding percentages of the combined company will be approximately 53% for Transocean and 47% for Valaris. The enterprise value is approximately $17 billion.

Highlights

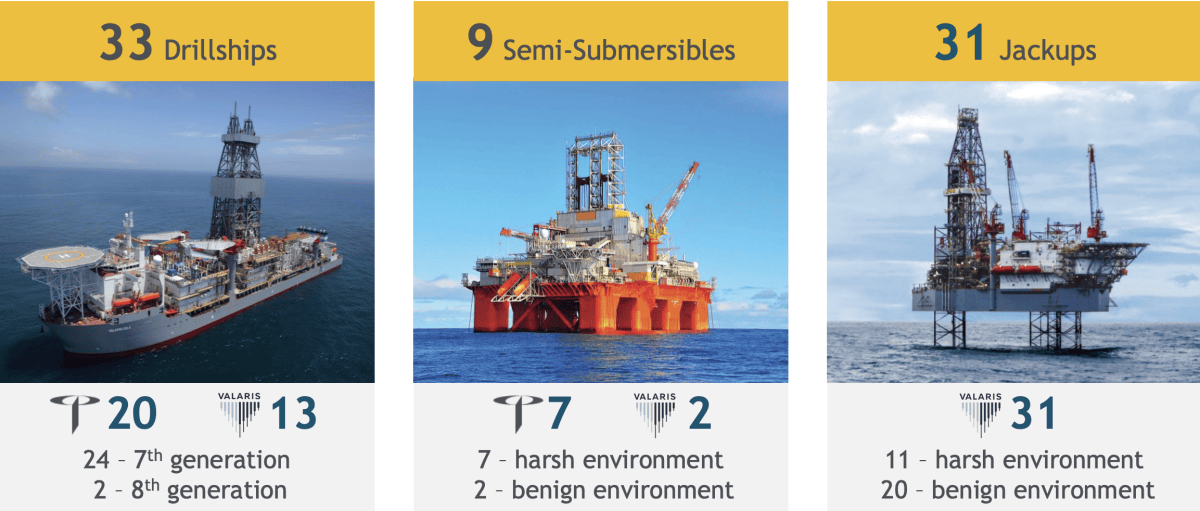

- Diversified offshore fleet of 73 rigs

- Expands reach in major offshore basins

- Over $200 million in cost synergies

- Stronger cash flow and balance sheet

- Estimated market capitalization of $12.3 billion

- Improved trading liquidity

Management Commentary

“This transaction creates a very attractive investment in the offshore drilling industry…”

— Keelan Adamson, President and CEO, Transocean

“By combining with Transocean, we will create a new industry leader…”

— Anton Dibowitz, CEO, Valaris

A Powerful Combination

The combined company will own 73 rigs serving customers in deepwater, harsh environment, and shallow water basins worldwide.

The combined backlog of approximately $10 billion enhances cash flow visibility. Identified synergies exceed $200 million.

The leadership team will be led by CEO Keelan Adamson, with Jeremy Thigpen as Executive Chairman.

Structure and Conditions

Valaris shareholders will receive 15.235 shares of Transocean stock for each Valaris share.

The transaction will be completed via a Bermuda court-approved scheme of arrangement and is expected to close in the second half of 2026.

Transaction Advisors

Evercore (Transocean Financial Advisor)

Hogan Lovells, Homburger, Appleby (Legal Advisors)

Goldman Sachs & Co. (Valaris Financial Advisor)

Skadden, Lenz & Staehlin, Conyers Dill (Legal Advisors)

Conference Call

Monday, February 9, 2026

8:00 a.m. CT / 9:00 a.m. ET

Dial-in: 800-579-2568 / +1 785-424-1222

Access Code: 984572

Webcast available at:

www.deepwater.com

www.valaris.com

About Transocean

Transocean is a leading international provider of offshore contract drilling services, specializing in ultra-deepwater and harsh environment drilling.

The company operates 27 offshore drilling units, including 20 ultra-deepwater and seven harsh environment floaters.

About Valaris

Valaris is a global leader in offshore drilling services across all water depths and geographies, with a focus on safety, technology, and innovation.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of federal securities laws. These statements involve risks and uncertainties that may cause actual results to differ materially.

Factors include regulatory approvals, market conditions, integration risks, economic developments, and operational challenges.

No obligation is assumed to update forward-looking statements.

Important Additional Information

Transocean and Valaris will file relevant materials with the SEC, including a joint proxy statement.

Investors are urged to read these materials carefully when available.

Participants in the Solicitation

Directors, officers, and employees of Transocean and Valaris may be participants in proxy solicitations.

Investor & Media Contacts

Transocean

David Keddington – VP, Treasurer

+1 713-232-7420

Sarah Davidson – Investor Relations

+1 713-232-7217

Kristina Mays – Media

+1 713-232-7734

Valaris

Nick Georgas – VP, Treasurer & IR

+1 713-979-4632

Tim Richardson – Director, IR

+1 713-979-4619

Andrew Siegel / Lyle Weston

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449